Pure Tax Investigations

When HMRC calls, we guide your business through the storm to secure peace of mind.

Visit

About Pure Tax Investigations

Imagine receiving a letter from HMRC. The official envelope feels heavy in your hands, its contents threatening to unravel years of hard work. This is where the journey with Pure Tax Investigations begins. We are not just advisors; we are your dedicated navigators through the stormy seas of tax disputes and investigations. Founded by Amit Puri, a former senior HMRC Tax Inspector with over two decades of experience, we specialise in acting as an independent, robust buffer between our clients and HMRC. Our mission is to provide peace of mind and clarity to businesses, entrepreneurs, and private clients facing everything from routine compliance checks to the most serious civil investigations under COP8 and COP9. We listen first, understanding that every client's story is unique, and then we fight tooth and nail with a tailored, pragmatic approach. Our core ethos is to preserve wealth, address deep-seated concerns, and help realise our clients' aspirations by turning a period of uncertainty into a journey toward resolution and security.

Features of Pure Tax Investigations

Frontline Expertise from a Former HMRC Inspector

Our team is led by Amit Puri, who spent over 20 years as a senior Tax Inspector at HMRC. This insider perspective is invaluable. We understand the tactics, priorities, and operational approaches of HMRC from the other side of the table. This allows us to anticipate challenges, craft compelling defences, and negotiate from a position of strength, ensuring our clients have a formidable advocate who speaks HMRC's language.

Bespoke, Client-Centric Strategy

We reject a one-size-fits-all approach. Your tax affairs and the investigation you face are unique. Our process starts with listening. We delve into your specific circumstances, concerns, and goals. From this understanding, we build a discreet, clear, and completely bespoke strategy designed to achieve the best commercial outcome while managing stress and providing certainty every step of the way.

Comprehensive Investigation & Disclosure Management

We provide end-to-end support across the entire spectrum of HMRC engagement. This includes managing serious civil fraud investigations (COP9), complex avoidance enquiries (COP8), compliance checks into large businesses, and facilitating voluntary disclosures through campaigns like the Worldwide Disclosure Facility (WDF) and Let Property Campaign (LPC). We handle the process so you can focus on your business.

Proactive Peace of Mind & Certainty

We recognise the profound pressure and intrusion a tax investigation brings. Our role extends beyond technical advice to being a steadying hand. We work tirelessly to demystify the process, provide clear timelines, and offer straightforward advice. Our goal is to lift the burden from your shoulders, providing the peace of mind that comes from having a dedicated, expert team in your corner.

Use Cases of Pure Tax Investigations

Navigating a Code of Practice 9 (COP9) Investigation

You have received a COP9 letter, indicating HMRC suspects serious tax fraud. This is a critical juncture. We guide you through the Contractual Disclosure Facility (CDF) process, helping you make a valid disclosure to avoid criminal prosecution. We manage all communication with HMRC's Fraud Investigation Service, building a robust defence to settle your affairs and secure your future.

Responding to an HMRC Compliance Check or Enquiry

HMRC has opened a routine enquiry into your company's tax return or a specific deduction, like R&D claims. The requests for information are piling up, distracting you from your business. We step in as your authorised agent, handling all correspondence, gathering the necessary evidence, and professionally challenging any unreasonable demands to bring the enquiry to a swift and fair conclusion.

Making a Voluntary Disclosure via a Campaign

You have undisclosed income from offshore assets, rental properties, or cryptocurrency gains. We help you voluntarily regularise your affairs through HMRC's disclosure facilities, such as the Worldwide Disclosure Facility (WDF) or Let Property Campaign (LPC). We prepare and submit a complete disclosure, negotiating the best possible terms to minimise penalties and interest, turning a problem into a resolved matter.

Defending Against Complex COP8 or Avoidance Scheme Enquiries

Your business or trust has used a tax planning arrangement now under scrutiny by HMRC's Counter Avoidance directorate under COP8. These are highly complex, technical investigations. Our specialists analyse the scheme, the relevant law, and HMRC's position to mount a rigorous defence, protecting your financial position through negotiation, Alternative Dispute Resolution (ADR), or at Tribunal if necessary.

Frequently Asked Questions

What makes Pure Tax Investigations different from my accountant?

While your accountant is vital for compliance, a tax investigation is a specialist adversarial process. We are dedicated tax defence specialists with frontline HMRC experience. We act as an independent buffer, focusing solely on investigation strategy, negotiation, and dispute resolution. We fight for you with a level of niche expertise and tactical understanding that general practice accountants typically do not possess.

How do you handle communication with HMRC during an investigation?

We become your authorised agent, meaning all direct communication from HMRC comes to us. We manage every letter, email, and phone call. This shields you from the stress and potential missteps of direct contact. We ensure all responses are strategic, consistent, and professionally crafted to protect your interests and steer the investigation toward a favourable resolution.

What is the typical outcome of a tax investigation you handle?

Our goal is always the optimal commercial outcome for your specific case. This can range from a successful "no change" conclusion where HMRC closes the enquiry, to negotiating a financial settlement that is significantly lower than HMRC's initial calculations. We also aim to secure certainty, finality, and the peace of mind that comes from having your affairs settled correctly and conclusively.

Do you only handle cases for large businesses?

Absolutely not. Our services are vital for entrepreneurs, private clients, SMEs, and large corporations alike. Tax investigations are deeply personal and stressful regardless of business size. We provide the same dedicated, senior-level expertise and bespoke approach to all our clients, whether facing a personal capital gains enquiry or a multi-million pound corporate tax dispute.

Explore more in this category:

Top Alternatives to Pure Tax Investigations

BlitzAPI

BlitzAPI empowers your GTM team with instant access to clean B2B data, driving growth through seamless API integrations.

echoloc

Echoloc finds companies ready to buy by turning their job posts into actionable sales signals.

Fieldtics

Fieldtics is your all-in-one platform to effortlessly schedule jobs, manage customers, and streamline invoicing for.

Moon Banking

Discover the world's largest bank dataset with AI integrations, empowering analysts, marketers, and developers globally.

Tailride

Tailride automates invoice and receipt management from your inbox, saving accountants time and reducing manual effort.

Tradepal

Tradepal transforms stock chart screenshots into actionable insights with AI-driven analysis, forecasts, and sentiment.

Boekhouder Vinden

Discover the perfect bookkeeper, accountant, or tax consultant in the Netherlands with free quotes from verified.

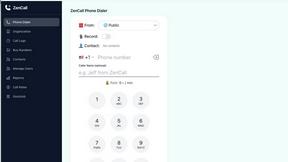

ZenCall

Experience crystal-clear international calls directly from your browser with ZenCall's simple pay-as-you-go pricing.