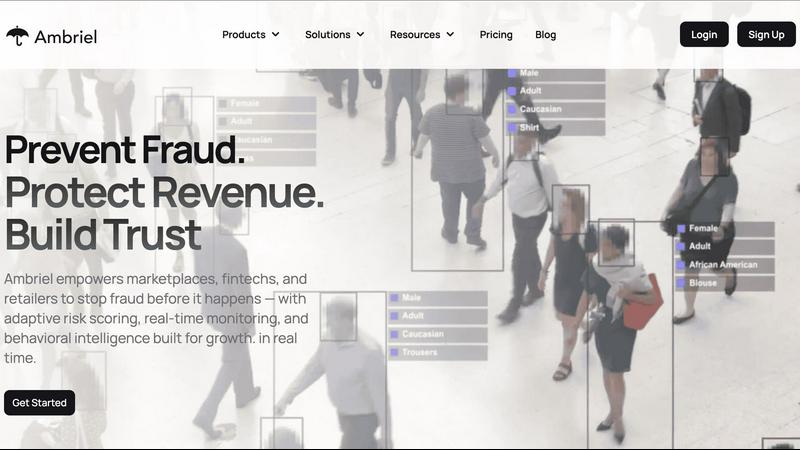

Ambriel

Ambriel guides your business from risk to trust by detecting and stopping fraud in real time.

Visit

About Ambriel

In the digital frontier, where opportunity and risk collide, every transaction tells a story. Ambriel is the trusted narrator, deciphering the complex plot of user behavior to separate genuine customers from fraudulent actors. It is an advanced fraud intelligence and risk management platform designed for the journey of modern digital businesses—fintech pioneers, bustling marketplaces, innovative retailers, and dynamic iGaming platforms. Ambriel understands that your growth depends on seamless user experiences, but that trust is your most valuable currency. Its core mission is to empower you to operate securely and comply with global regulations while fiercely protecting that trust, ensuring no friction is added to a legitimate customer's journey. By weaving together behavioral analytics, device intelligence, sanctions screening, and real-time risk scoring into a single, powerful ecosystem, Ambriel provides the clarity needed to detect, score, and prevent fraud before it can impact your revenue or reputation. It’s more than a shield; it's an intelligence partner that helps you build a safer, more trustworthy digital world.

Features of Ambriel

AI-Driven Risk Scoring Engine

At the heart of Ambriel's narrative is its powerful AI-driven risk scoring engine. This feature analyzes thousands of data points from over 200 sources in real-time, assessing transactions, user behaviors, and network signals. It doesn't just flag activity; it tells you the story of the risk, providing a clear, actionable score that predicts fraud before it completes. This allows your team to make confident decisions instantly, protecting revenue without second-guessing.

Automated Sanctions & PEP Screening

Navigating the complex landscape of global compliance is a journey fraught with manual checks and potential oversight. Ambriel automates this critical path, screening users and transactions against 100+ global sanctions, Politically Exposed Person (PEP), and crime watchlists. This continuous, automated process ensures you meet stringent regulatory requirements for AML and KYC without slowing down your onboarding or transaction flows, turning a compliance burden into a seamless operational step.

Continuous Behavioral Monitoring

Fraud is not a single event but a pattern that unfolds over time. Ambriel’s continuous monitoring feature acts as a vigilant sentinel, tracking accounts and transactions 24/7. It learns the normal rhythm of your users' behavior and immediately alerts you to unusual patterns—anomalous login locations, sudden changes in transaction values, or suspicious account activity—long before they escalate into costly fraud cases or security breaches.

Frictionless Onboarding Flows

The first chapter of a user's journey is critical. Ambriel enables you to design seamless onboarding flows that welcome trusted customers while filtering out bad actors. By integrating automated fraud checks and risk assessments directly into the sign-up process, you can verify identities, detect synthetic fraud, and block bot-driven signups instantly. This ensures only legitimate users join your platform, building a foundation of trust from the very first click.

Use Cases of Ambriel

Onboarding & Registration Fraud

The journey begins at sign-up, where fraudsters often create fake accounts or synthetic identities. Ambriel analyzes registration signals in real-time to detect bot-driven signups, stolen information, and coordinated fraud rings. This allows platforms to stop exploitative users before they can abuse services, protecting promotional budgets and ensuring the community is built on genuine users.

Payment & Transaction Fraud

During the crucial moment of a transaction, Ambriel's real-time monitoring springs into action. It scrutinizes each payment for anomalies, mismatched device profiles, and high-risk patterns to prevent fraudulent purchases, chargebacks, and unauthorized transfers. This safeguards revenue directly at the point of sale, ensuring legitimate transactions flow smoothly while fraudulent ones are halted.

Bonus & Promotion Abuse

Loyalty programs and promotional incentives are meant to reward genuine users, not fraudsters. Ambriel identifies sophisticated abuse schemes like multi-accounting, referral scams, and bonus harvesting. By spotting users who exploit these systems, it helps ensure marketing spend drives real engagement and fair rewards, protecting profitability and campaign integrity.

Account Takeover Protection

A user's account is their digital home. Ambriel protects it by identifying takeover attempts through unusual login behavior, credential stuffing attacks, and suspicious device changes. By alerting on these risks, it enables proactive intervention—like step-up authentication—to keep legitimate customers secure and maintain their trust in your platform's safety.

Frequently Asked Questions

What types of fraud can Ambriel detect?

Ambriel is designed to identify a wide spectrum of modern digital fraud. This includes synthetic identity creation, payment fraud and chargebacks, money laundering patterns, bonus and promotion abuse (like multi-accounting), referral fraud, account takeover attempts, and refund or return policy exploitation. Its AI models are trained to uncover hidden risk patterns across user journeys.

How does Ambriel ensure compliance for my business?

Ambriel automates core compliance workflows. Its integrated system performs automated screening against global sanctions, PEP, and adverse media lists, providing audit trails for AML and KYC regulations. The platform is also built with privacy-by-design principles, aiding adherence to GDPR, and its infrastructure supports standards like PCI DSS and ISO 27001.

Is Ambriel difficult to integrate into our existing systems?

No, Ambriel is built for seamless integration. It offers flexible APIs and pre-built integrations for major e-commerce platforms like Magento, WooCommerce, and Wix Commerce. This allows your engineering team to embed Ambriel's fraud detection and screening capabilities directly into your user onboarding, transaction, and monitoring workflows with minimal disruption.

Can Ambriel adapt to different industries like fintech and e-commerce?

Absolutely. Ambriel's narrative is tailored to the unique fraud journeys of various sectors. Its risk models and features are adaptable, whether you're a fintech company needing stringent sanctions screening, a marketplace verifying buyer and seller trust, an e-commerce retailer preventing payment fraud, or an iGaming platform stopping bonus abuse. The platform provides industry-specific insights and rules.

You may also like:

FilexHost

The simplest way to host & share your files. Drag & drop any file to get a live shareable URL in seconds

Mailopoly

An AI-powered email client that instantly cuts your inbox in half, provides an AI Personal Assistant, Extracts key information, manages tasks and more

LuxSign

LuxSign is an electronic signature platform from Luxembourg. It is eIDAS SES compliant, making signatures legally valid across all EU member states.