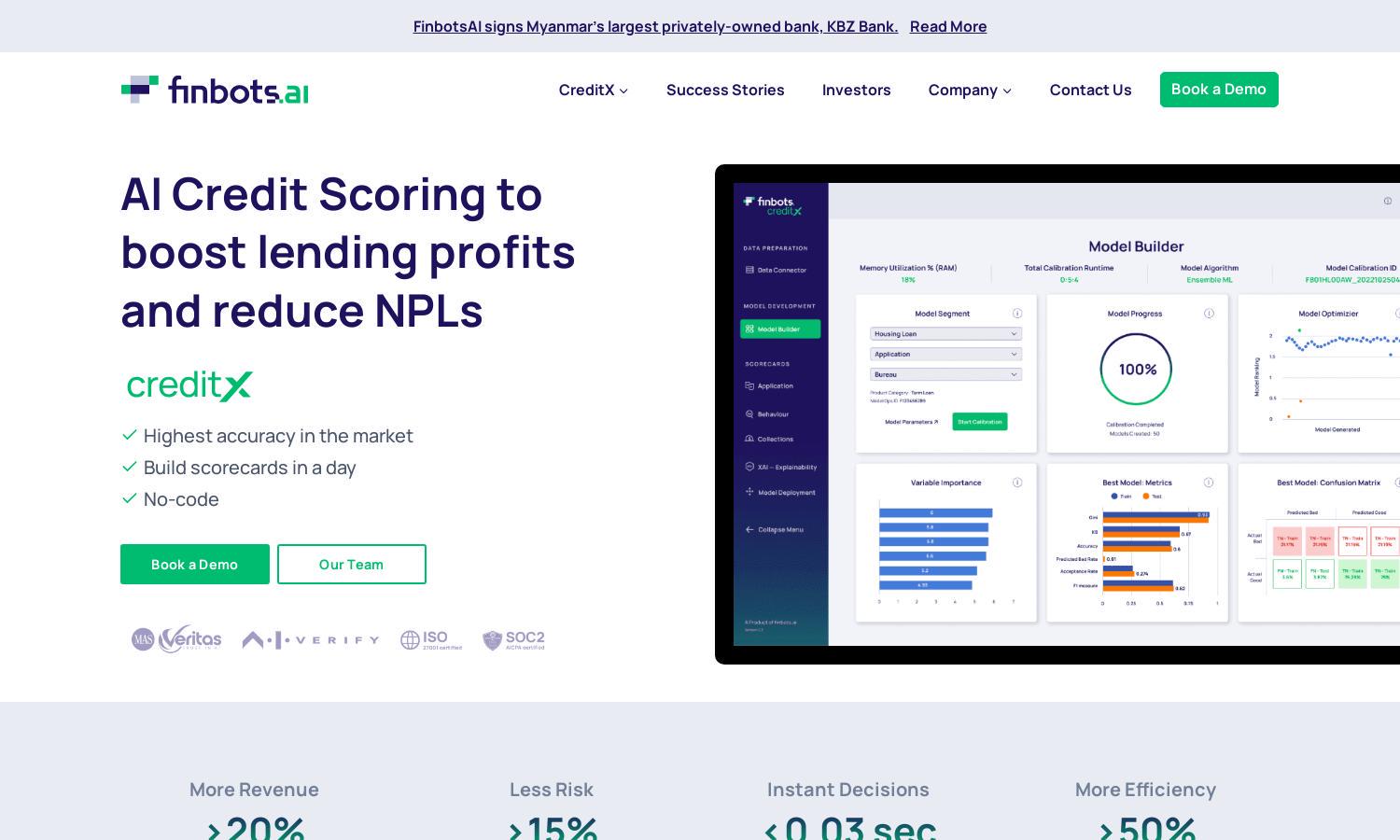

finbots.ai

About finbots.ai

finbots.ai is an advanced AI credit risk platform designed for lenders seeking efficiency and accuracy. With its CreditX solution, users can effortlessly create custom scorecards, automate credit scoring, and enhance decision-making processes. Experience faster approvals and reduced risk, making finbots.ai an essential tool for modern lending.

finbots.ai offers flexible pricing for its CreditX platform, catering to different organizational needs. Plans include affordable options for startups and robust tiers for larger financial institutions. Subscribe now to take advantage of introductory offers, ensuring you maximize profitability while using finbots.ai's cutting-edge credit scoring capabilities.

The user interface of finbots.ai is designed for ease of navigation, making it accessible for lenders. With a clean layout and intuitive features, users can quickly build scorecards and access decision-making tools, promoting a seamless experience. finbots.ai prioritizes user engagement with strong focus on functionality and clarity.

How finbots.ai works

Users begin their journey with finbots.ai by signing up for CreditX, where they can seamlessly integrate internal and external data sources. Once onboarded, they can utilize special features like automated data validation and model building. The platform allows for rapid deployment of custom scorecards, enabling instant decision-making, enhancing user experience and efficiency.

Key Features for finbots.ai

Rapid Scorecard Development

finbots.ai's rapid scorecard development is a defining feature of its CreditX platform. Users can build and deploy custom scorecards within a day, using advanced AI technology that significantly streamlines the credit assessment process. This unique capability empowers lenders to make informed decisions faster than ever.

Real-Time Decisioning

Real-time decisioning is a standout feature of finbots.ai's CreditX solution. This capability enables lenders to provide instant approvals, enhancing the user experience and improving customer satisfaction. With cutting-edge AI, finbots.ai ensures that decision-making is both quick and accurate, minimizing risks and maximizing lending opportunities.

Data Integration

The data integration feature of finbots.ai allows seamless connection to multiple data sources, enhancing the accuracy of credit assessments. Users can incorporate internal, external, and alternative data easily, resulting in comprehensive credit profiles. This unique flexibility sets finbots.ai apart, facilitating more informed lending decisions.

You may also like: