Zeni

About Zeni

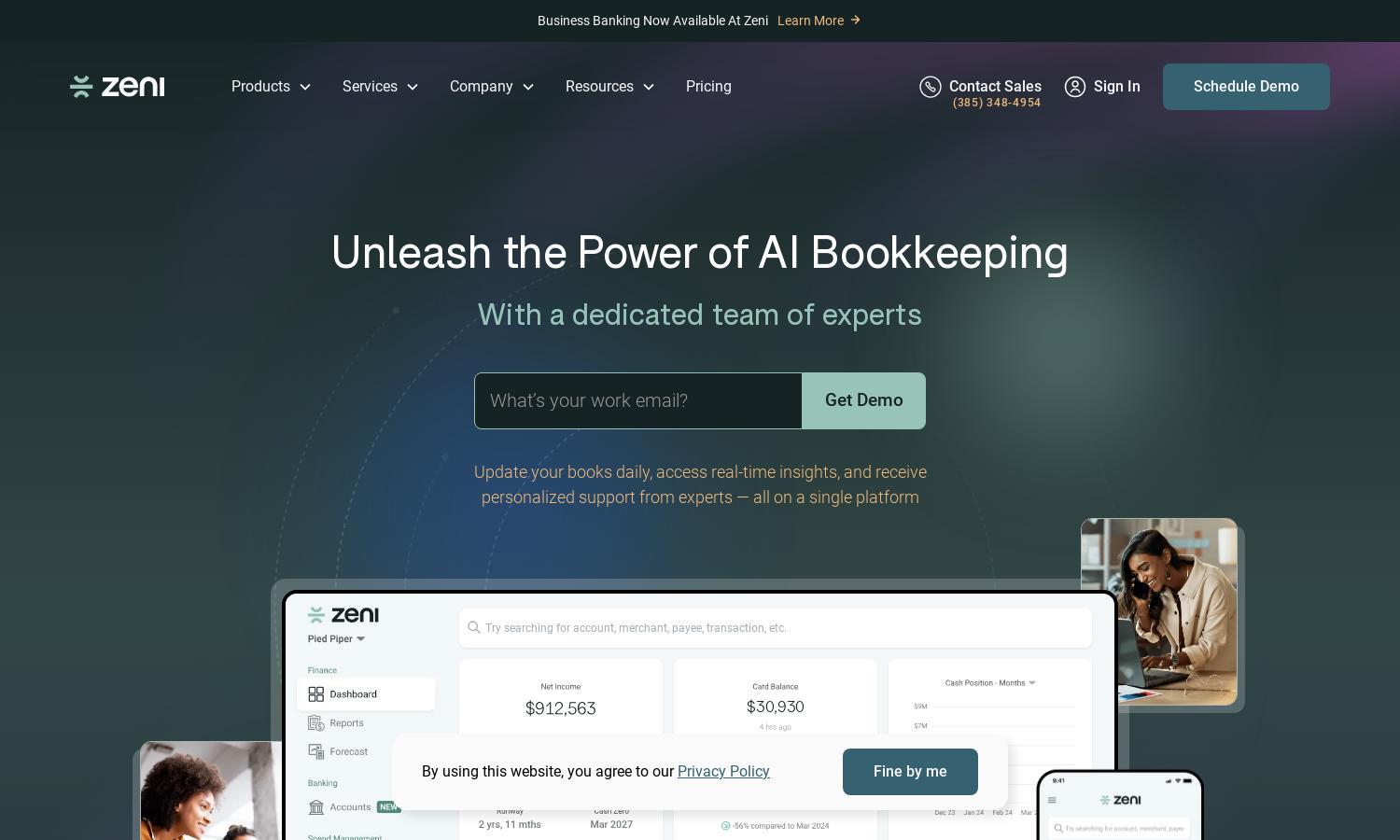

Zeni delivers innovative AI-driven bookkeeping tools designed to simplify financial operations for businesses. By integrating advanced receipt analysis and automated workflows, Zeni enables users to streamline bookkeeping tasks. The platform is ideal for startups and growing companies needing efficient bookkeeping solutions, ensuring proper financial management and insights.

Zeni offers competitive pricing tiers, including tailored plans for startups and larger businesses. Each tier provides unique benefits, such as automated bookkeeping, financial consultations, and access to tax and payroll services. Users gain exceptional value with discounts for annual subscriptions, enhancing their financial management experience while maximizing savings.

Zeni features an intuitive user interface that enhances the overall browsing experience. Its neatly organized dashboard allows users to easily navigate through various financial services, like bookkeeping, bill payments, and reimbursements. The seamless design ensures users can access tools effortlessly, fostering better financial management and oversight.

How Zeni works

Users begin their experience with Zeni by signing up and onboarding, where they connect financial accounts and set up necessary permissions. The platform’s AI automates the categorization of transactions and prepares financial reports. Users can navigate effortlessly through features for bookkeeping, payroll, and tracking expenses, receiving support from Zeni's financial experts throughout the process.

Key Features for Zeni

AI-Driven Bookkeeping

Zeni's standout feature, AI-driven bookkeeping, automates financial processes, ensuring accuracy and efficiency. This unique capability allows businesses to focus on growth while Zeni handles receipt analysis, reconciliation, and vendor verification, significantly reducing the time and effort spent on managing finances.

AI Bill Pay

Zeni's AI Bill Pay simplifies user transactions by auto-reading invoices and integrating customizable workflows. This functionality ensures that businesses make timely payments effortlessly while avoiding late fees, enhancing cash flow management and contributing to overall financial health.

Dedicated Finance Team

Zeni's dedicated finance team sets the platform apart, providing personalized support tailored to client needs. This expert backing helps businesses navigate financial complexities, ensuring compliance and optimizing strategies for growth while leveraging Zeni's innovative financial technology.

You may also like: