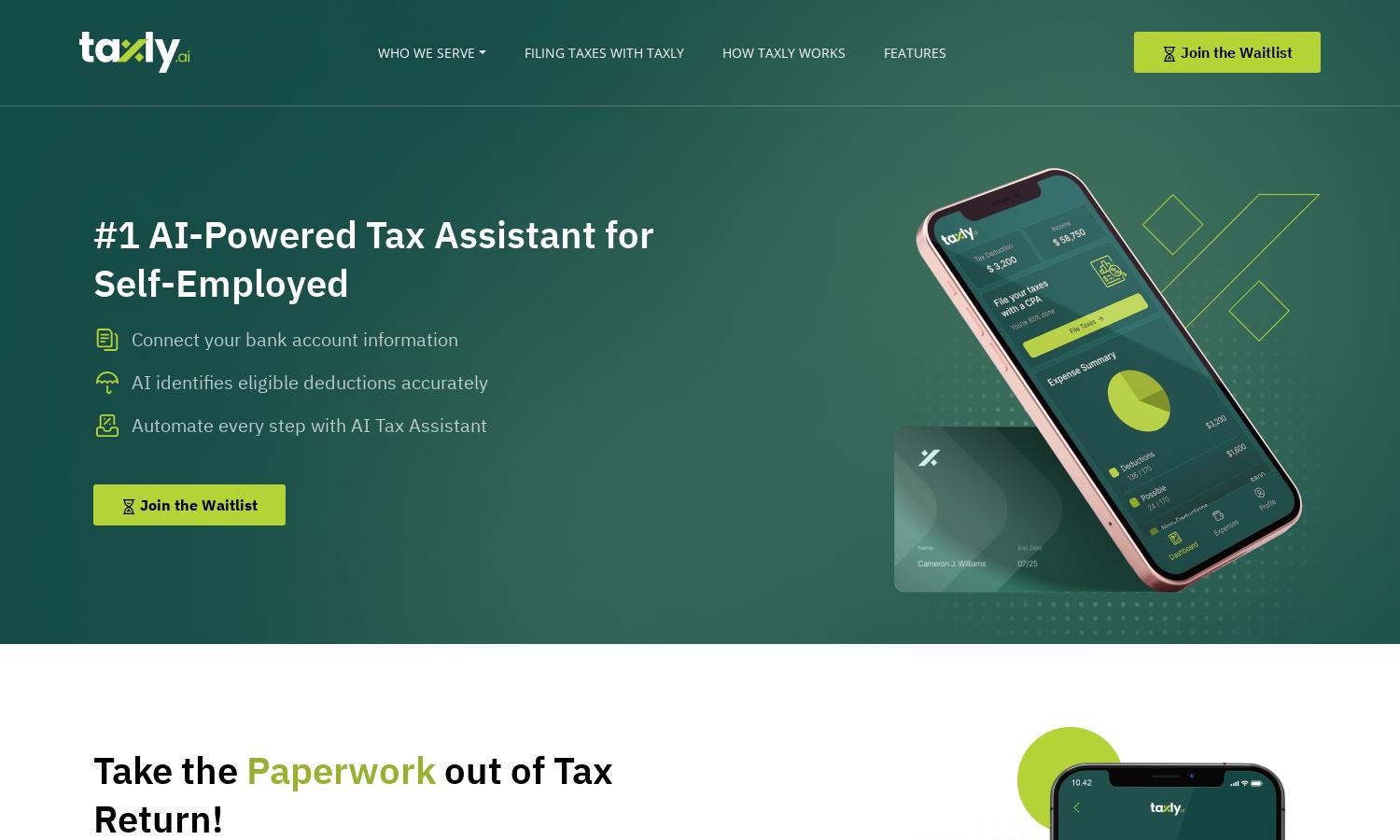

Taxly.ai

About Taxly.ai

Taxly.ai is a cutting-edge AI-powered tax filing platform designed for self-employed individuals in Australia. It simplifies tax management by automating deduction identification and expense tracking, offering personalized CPA support. Users benefit from its innovative AI scanning technology, which maximizes savings and ensures compliance with ATO guidelines effortlessly.

Taxly.ai offers a flexible pricing model with subscription tiers to suit different users' needs. Each plan provides access to powerful tax management tools, real-time expense tracking, and expert CPA consultations. Users gain additional value with upgraded plans, ensuring a seamless, comprehensive tax preparation experience.

Taxly.ai boasts an intuitive user interface, designed to streamline the tax filing process. Users can navigate effortlessly through their tax activities, manage expenses, and access vital records from a centralized dashboard. The user-friendly layout enhances the overall experience, making tax management simpler and more efficient.

How Taxly.ai works

To get started with Taxly.ai, users sign up and connect their transaction records for automated expense tracking. The platform utilizes AI to scan for eligible deductions, categorizing them accurately. Users can manage their records, view tax activity, and consult with CPAs for personalized advice, all ensuring a seamless tax filing experience.

Key Features for Taxly.ai

AI-Powered Deduction Identification

Taxly.ai features advanced AI-powered deduction identification that automatically scans and categorizes transactions, ensuring users never miss a tax-saving opportunity. This innovative function simplifies tax management, allowing self-employed individuals and freelancers to maximize deductions efficiently while minimizing their tax liabilities.

Expert CPA Support

Expert CPA support is a key feature of Taxly.ai, providing users with access to certified tax professionals. This ensures personalized guidance throughout the tax preparation process, allowing users to ask questions, review their records, and receive tailored advice for maximizing deductions and ensuring compliance.

Real-Time Expense Tracking

Taxly.ai offers real-time expense tracking, allowing users to monitor their spending effortlessly. This feature categorizes expenses automatically, improving accuracy for tax returns. With the ability to track expenses in real time, users can make informed financial decisions and optimize their tax deductions at all times.