TaxGPT

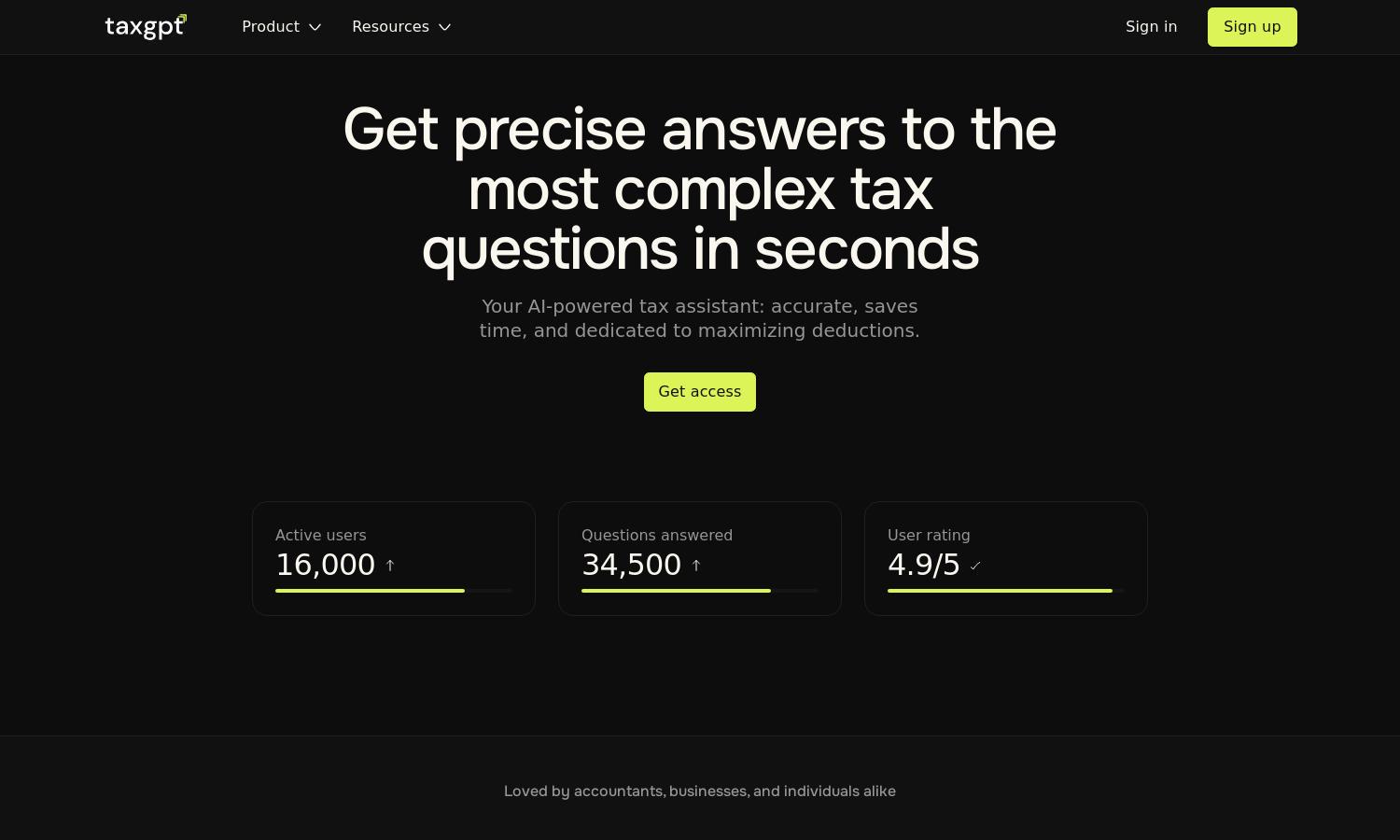

About TaxGPT

TaxGPT is a revolutionary AI-powered tax assistant tailored for accountants and tax professionals seeking efficiency. By harnessing advanced technology, TaxGPT provides accurate tax solutions, enabling users to streamline their operations, enhance productivity, and save time, ensuring their clients always receive top-tier support.

TaxGPT offers a free 14-day trial, with subscription plans designed for professionals needing access to advanced features. Users can upgrade for exclusive benefits, which enhance their tax research capabilities and operational efficiency, making it a valuable asset for tax professionals looking to maximize their productivity.

TaxGPT features a user-friendly interface designed for optimal experience. Its seamless layout promotes easy navigation through key functionalities, ensuring users can quickly access tax assistance tools. The innovative design enhances overall engagement, making TaxGPT an effective resource for tax professionals looking to improve client interactions.

How TaxGPT works

Using TaxGPT is simple—users start by signing up for early access and quickly onboard. Once logged in, they can easily navigate the dashboard to access various features like tax research, memo writing, and client support. The intuitive design ensures a seamless experience, allowing tax professionals to efficiently handle queries and improve their workflow.

Key Features for TaxGPT

AI-Powered Tax Research

TaxGPT specializes in AI-driven tax research, allowing users to ask complex questions and receive accurate answers. This unique capability greatly reduces research time and enhances decision-making, making TaxGPT an invaluable tool for tax professionals seeking to improve their efficiency and accuracy in tax-related tasks.

Memo Writing Functionality

With TaxGPT's memo writing functionality, users can generate comprehensive tax memos effortlessly. This feature streamlines documentation processes, saving valuable time and ensuring accuracy, ultimately helping tax professionals maintain a high standard of service delivery for their clients while simplifying complex tax issues.

Secure Data Handling

TaxGPT prioritizes user data security, offering top-notch encryption to ensure confidentiality. This commitment to secure data handling instills trust among users, allowing tax professionals to confidently leverage the platform without concerns about sensitive information being compromised while navigating their tax-related activities.