Skwad

About Skwad

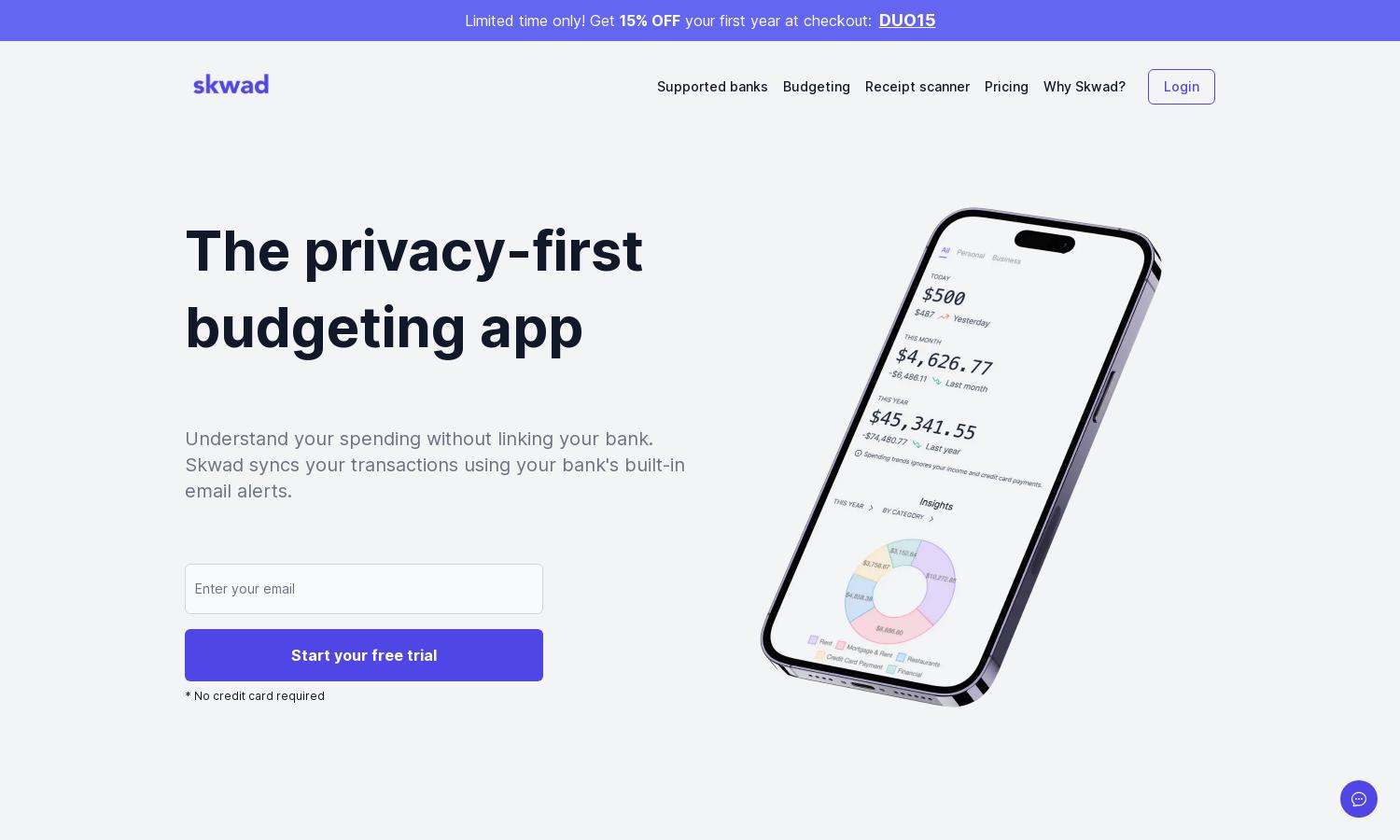

Skwad is designed for users seeking a secure, privacy-oriented budgeting solution. By utilizing email alerts from banks, Skwad allows users to track their finances effortlessly. This innovative approach ensures that your sensitive information remains protected while enabling instant transaction categorization and financial analysis.

Skwad offers various subscription plans, including a discounted first-year option at 15% off using code DUO15. Users can explore different plans tailored to their budgeting needs, with each tier unlocking unique features. Upgrading enhances financial control, making Skwad an excellent choice for comprehensive budget management.

The user interface of Skwad is designed for simplicity and efficiency, ensuring a smooth browsing experience. Key features include intuitive navigation and seamless integration of transaction alerts, allowing users to manage their finances effortlessly. Skwad's layout is user-friendly, prioritizing accessibility and a straightforward budgeting process.

How Skwad works

Users begin by signing up for Skwad, receiving a unique email address to forward bank alerts. After setting up alerts from their bank or credit card provider, they can easily categorize transactions as Skwad processes them in real-time. This streamlined process requires no bank login, enhancing privacy and user experience.

Key Features for Skwad

Automated Transaction Syncing

Skwad's automated transaction syncing feature streamlines budgeting by converting bank alerts into categorized transactions instantly. Users receive real-time insights without needing to provide sensitive bank information, enhancing security. This innovative approach makes it easier to track spending and maintain financial clarity effortlessly.

Receipt Scanning

The receipt scanning feature of Skwad allows users to capture and categorize expenses quickly. By uploading images of receipts, users can enhance their financial records seamlessly. This functionality complements the automated syncing process, providing detailed insights into spending patterns without the hassle of manual entry.

Multi-User Collaboration

Skwad's multiplayer mode enables users to collaborate on budgeting and financial tracking with companions. This unique feature allows users to share insights, expenses, and budgets, promoting teamwork and accountability in achieving financial goals. It's an excellent way to manage group finances effectively and eliminate debt together.

You may also like: