Sixfold

About Sixfold

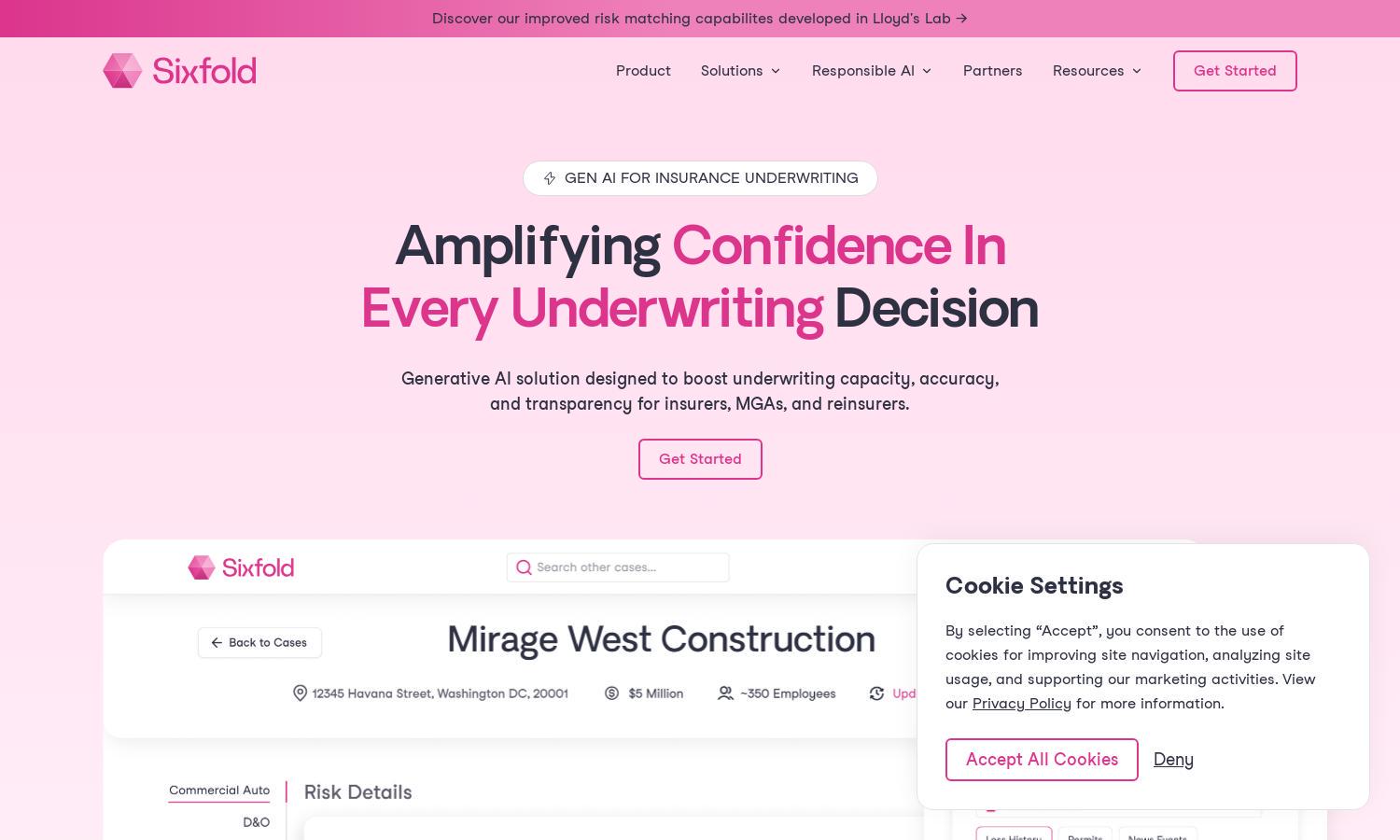

Sixfold is a cutting-edge platform designed for insurance underwriters, leveraging generative AI to enhance workflows. This innovative tool automates risk assessment, synthesizes data, and provides actionable insights tailored to individual risk appetites, empowering underwriters to make informed decisions while improving efficiency and transparency.

Sixfold offers flexible pricing with tailored subscription tiers suited for different underwriting needs. Each plan provides value through access to advanced AI capabilities and automated workflows. Upgrading unlocks additional features and insights, ensuring insurance professionals stay ahead in a competitive landscape while maximizing operational efficiency.

The user interface of Sixfold is designed for seamless navigation and efficiency. Its intuitive layout allows underwriters to easily access tools and insights, enhancing user experience. Unique features like data synthesis and risk visualization make Sixfold an essential platform for modern underwriting tasks, streamlining processes for users.

How Sixfold works

To interact with Sixfold, users start by onboarding their underwriting guidelines into the platform, which then ingests and analyzes the data. Once set up, users can navigate through sophisticated tools that triage submissions, detect risk signals, and generate tailored recommendations, allowing them to overcome underwriting challenges efficiently.

Key Features for Sixfold

Generative AI Co-Pilot

Sixfold's generative AI co-pilot is a standout feature that revolutionizes insurance underwriting. It automates data synthesis and decision-making, helping underwriters accurately assess risk factors and make informed choices swiftly, ultimately enhancing productivity and improving risk management outcomes.

Automated Workflow Insights

Sixfold provides automated workflow insights that streamline the underwriting process. This feature aggregates and analyzes diverse data sources, allowing underwriters to efficiently identify patterns and discrepancies, resulting in more accurate risk assessments and faster decision-making in a competitive market.

Full Transparency in Underwriting

Full transparency in underwriting decisions is a key feature of Sixfold, ensuring all processes are traceable. This allows users to verify data sources and decision pathways, promoting accountability and compliance while enabling underwriters to confidently engage with their guidelines and results.