Pennyflo

About Pennyflo

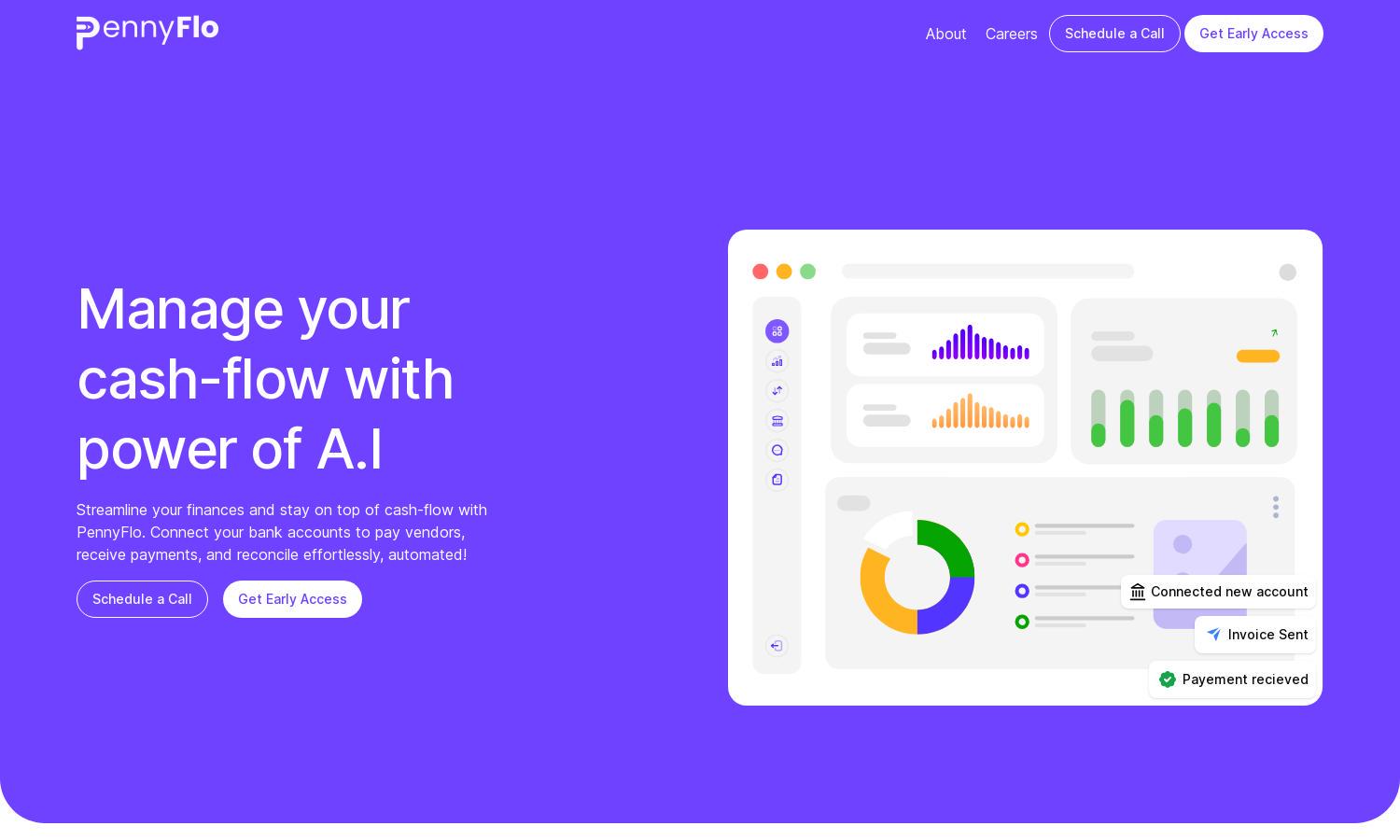

Pennyflo delivers a comprehensive AI-powered cash management solution, designed specifically for finance teams seeking to optimize their workflows. With unique features like real-time cash flow visibility and automated banking reconciliations, Pennyflo simplifies financial operations, enabling users to make informed decisions and combat cash shortage challenges effectively.

Pennyflo’s pricing plans cater to various business needs, offering scalable solutions for all sizes. Each tier provides essential features at competitive rates, ensuring users get maximum value. Upgrading to higher tiers unlocks advanced analytics and additional tools, enabling businesses to leverage the full potential of their cash management strategies.

Pennyflo boasts an intuitive user interface that enhances the browsing experience. Its well-structured layout offers easy navigation through various features, ensuring users can effortlessly access cash flow reports, banking tools, and analytics. The design prioritizes user-friendliness, making cash management efficient and straightforward for every business.

How Pennyflo works

Users begin their journey with Pennyflo by signing up for an account, where they can easily input their financial data for seamless integration. The platform's AI then analyzes this information to provide real-time cash flow visibility. Customers utilize interactive dashboards to collaborate and automate workflows, making data-driven decisions that enhance their financial strategies.

Key Features for Pennyflo

Real-Time Cash Flow View

Pennyflo's Real-Time Cash Flow View feature provides businesses with an immediate snapshot of their financial status. This innovative tool allows finance teams to monitor cash movements continuously, facilitating timely decision-making and reducing risks associated with cash shortages, ultimately improving financial management.

Automated Banking & Reconciliations

The Automated Banking & Reconciliations feature of Pennyflo simplifies financial processes by automating transaction matching. This innovation saves time and minimizes errors, ensuring accurate financial records while allowing finance teams to focus on strategic tasks rather than tedious reconciliations, enhancing overall operational efficiency.

Dynamic Forecasting

Pennyflo's Dynamic Forecasting tool empowers businesses to leverage historical data for predicting future scenarios. This feature offers valuable insights, allowing finance teams to plan their cash flow effectively, adapt strategies proactively, and mitigate potential financial challenges, ensuring sustainable growth and profitability.