Kniru

About Kniru

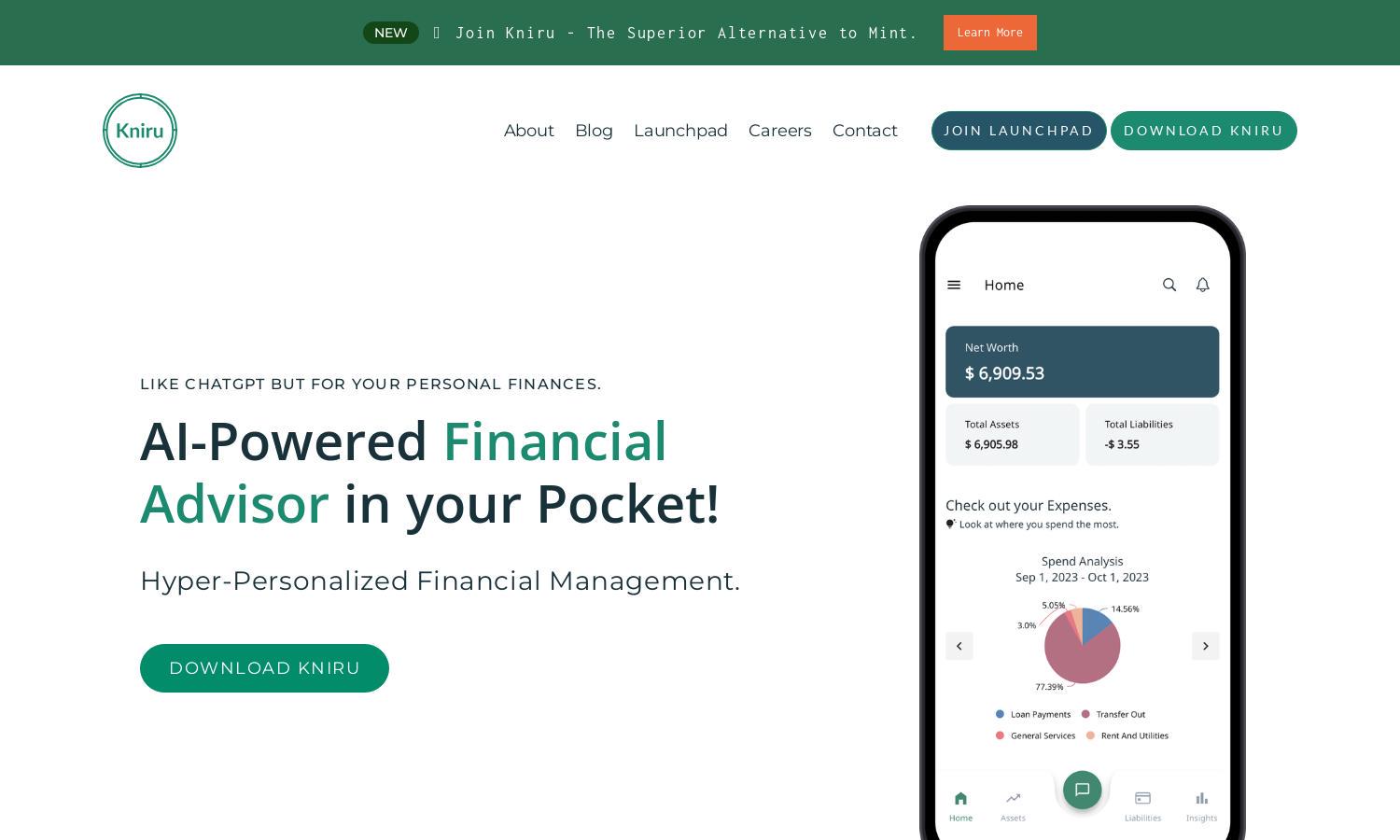

Kniru is a cutting-edge AI-powered financial advisor designed for individuals seeking personalized financial guidance. By simplifying wealth management, expense tracking, and tax planning, Kniru empowers users with actionable insights. Its innovative chat feature allows users to interact seamlessly for real-time financial advice tailored to their unique situations.

Kniru offers a variety of pricing plans tailored to different user needs. Each tier provides distinct features, with premium options delivering enhanced functionality for advanced financial management. Users benefit from special discounts on long-term subscriptions that encourage upgrading for a richer experience in personal finance management.

Kniru's user interface offers a seamless and intuitive browsing experience, designed for ease of navigation. Its clean layout and user-friendly features, such as comprehensive dashboards for assets and liabilities, make it straightforward to access crucial financial information. Kniru's design prioritizes user engagement and efficient financial management.

How Kniru works

Users start their journey with Kniru by easily onboarding their financial accounts, enabling the platform to analyze their financial landscape. Once set up, users can navigate through the chat feature to get personalized advice, manage investments, and receive notifications and reminders for expenses, savings, and budget alerts—all powered by AI intelligence.

Key Features for Kniru

AI-Powered Chat

Kniru's AI-powered chat feature serves as a dynamic financial assistant, providing real-time answers to users' financial questions. This innovative tool simplifies access to personalized advice on wealth management, tax strategies, and expense tracking, making financial decision-making more efficient and user-friendly.

Global Account Connectivity

Kniru offers fully automatic connections to personal accounts across multiple countries, including the US and India. This unique feature enables users to manage their finances globally and simplifies the tracking of assets and liabilities, all while providing valuable insights tailored to their individual financial situation.

Personalized Notifications

Kniru's state-of-the-art notification system enhances user experience by delivering timely reminders for bill payments, budget alerts, and savings suggestions. This functionality helps users stay proactive with their financial commitments, ensuring they remain informed and on top of their financial goals effectively.

You may also like: