Kintsugi

About Kintsugi

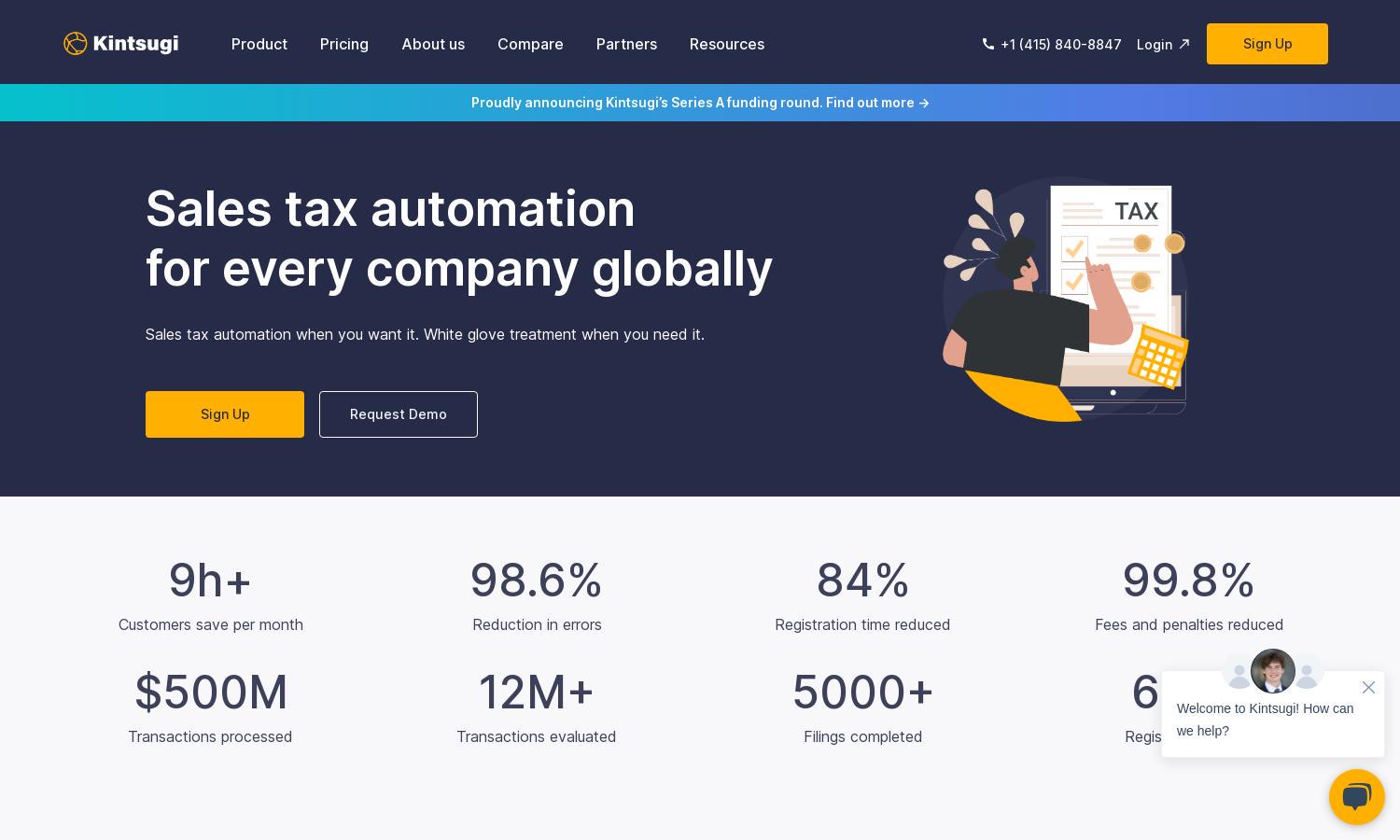

Kintsugi is a leading Sales Tax Automation solution designed for businesses seeking efficient compliance. It simplifies the tax process by integrating directly with billing and management systems, allowing users to register and remit taxes effortlessly. With innovative automation, Kintsugi helps businesses reduce errors and avoid penalties.

Kintsugi offers a pay-as-you-go model with no long-term contracts or implementation fees. Users start for free, enjoying comprehensive sales tax management. Subscriptions only incur fees when filing or registering. This flexible pricing structure ensures that businesses can scale their use of Kintsugi according to their growth.

Kintsugi's user-friendly interface creates a seamless browsing experience, with clear navigation and easy-to-access features. Designed for simplicity, the layout allows businesses to quickly monitor their tax liabilities and automate compliance processes. This intuitive design ensures users can manage sales tax with minimal stress and efficiency.

How Kintsugi works

Users begin by connecting their billing, payment, and HR systems to Kintsugi. The onboarding process is simple, allowing immediate access to tax compliance tools. Once connected, users can register necessary tax compliance in various states effortlessly, monitor liabilities, and automate remittance procedures, ensuring accurate and timely filings.

Key Features for Kintsugi

Automated Sales Tax Calculation

Kintsugi's automated sales tax calculation feature leverages advanced algorithms to ensure accuracy in tax collection. By adapting to specific jurisdictional rules, it minimizes errors and ensures businesses are consistently compliant. This functionality significantly reduces the hassle of manual calculations, streamlining operations for users.

Seamless E-commerce Integration

Kintsugi offers seamless integration with major e-commerce platforms like Shopify and QuickBooks. This feature ensures that sales tax compliance occurs automatically during transactions, enhancing efficiency and accuracy. Businesses can operate smoothly without worrying about manual tax calculations, thanks to Kintsugi's robust integration capabilities.

Automated Registration Alerts

Kintsugi provides automated registration alerts that keep users informed of their tax registration status. This key feature ensures that businesses are always aware of their nexus in various states, allowing them to register proactively. By handling these alerts, Kintsugi helps users avoid costly compliance issues.