Jinnee

About Jinnee

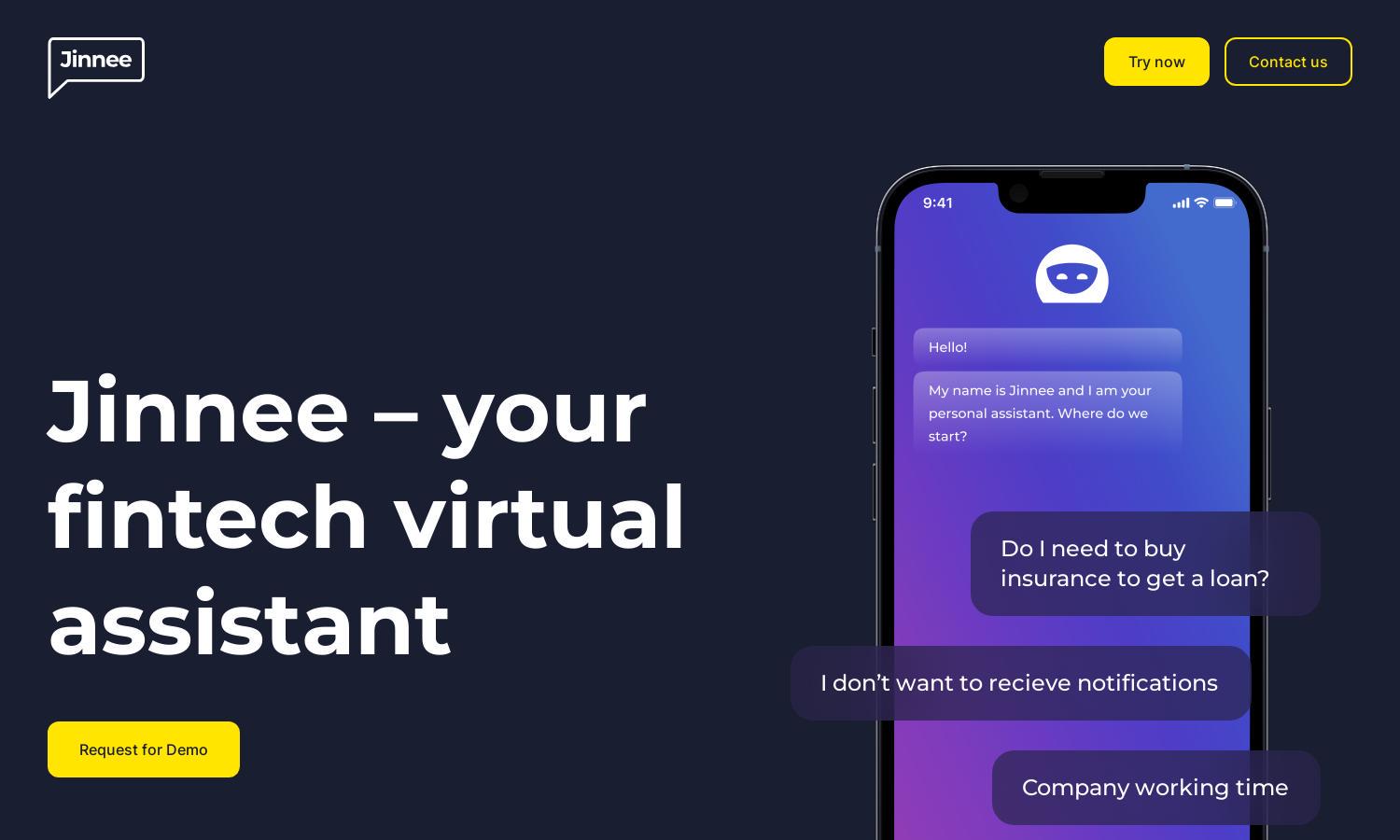

Jinnee is an innovative AI chatbot designed for fintech businesses, enhancing customer support and engagement. With personalized banking services and continuous learning from user interactions, Jinnee provides quick responses and valuable insights, helping financial institutions improve customer satisfaction and operational efficiency.

Jinnee offers flexible pricing plans catering to different business needs, allowing users to choose based on their customer interaction volume. Each tier provides access to advanced analytics and support capabilities. Upgrading offers enhanced features, driving improved client engagement and satisfaction for fintech companies.

Jinnee features an intuitive user interface designed for seamless navigation and easy accessibility. With a clear visual layout and user-friendly tools for building chatbots, Jinnee ensures an enjoyable experience. The platform’s design promotes efficient use, allowing users to focus on enhancing customer support.

How Jinnee works

Users begin their journey with Jinnee by creating an account. They can then set up their chatbot using templates or custom designs without needing technical skills. The platform guides users through building automated responses, analyzing customer queries, and generating insightful metrics, ensuring continuous optimization of the chatbot experience.

Key Features for Jinnee

24/7 Automated Support

Jinnee’s 24/7 automated support feature revolutionizes customer service for fintech companies by providing instant responses to inquiries. This functionality allows businesses to handle a large volume of queries efficiently while ensuring clients receive timely assistance, enhancing overall satisfaction with seamless support.

Personalized Banking Services

Jinnee excels in offering personalized banking services by acting as a virtual financial advisor. Clients receive immediate answers tailored to their financial needs, giving them instant access to information such as spending reports and savings plans, which significantly improves user experience and satisfaction.

Insightful Analytics

The insightful analytics feature of Jinnee empowers businesses to track customer interactions and preferences. By effectively collecting and analyzing inquiry data, Jinnee helps fintech companies understand client needs, adjust strategies, and enhance service offerings, thus driving greater customer engagement and satisfaction.