CPA Pilot

About CPA Pilot

CPA Pilot is an AI-powered tax assistant designed for tax professionals. It streamlines the process by providing instant access to authoritative resources, enabling users to conduct detailed tax research, generate custom tax strategies, and enhance client communication, ultimately transforming how accountants work.

CPA Pilot offers various subscription tiers, including Light, Average, and Power Users, tailored for different needs. Users can enjoy a 7-day free trial for each plan. Upgrading unlocks more messages monthly and ensures comprehensive access to powerful AI tools for optimizing tax practice efficiency.

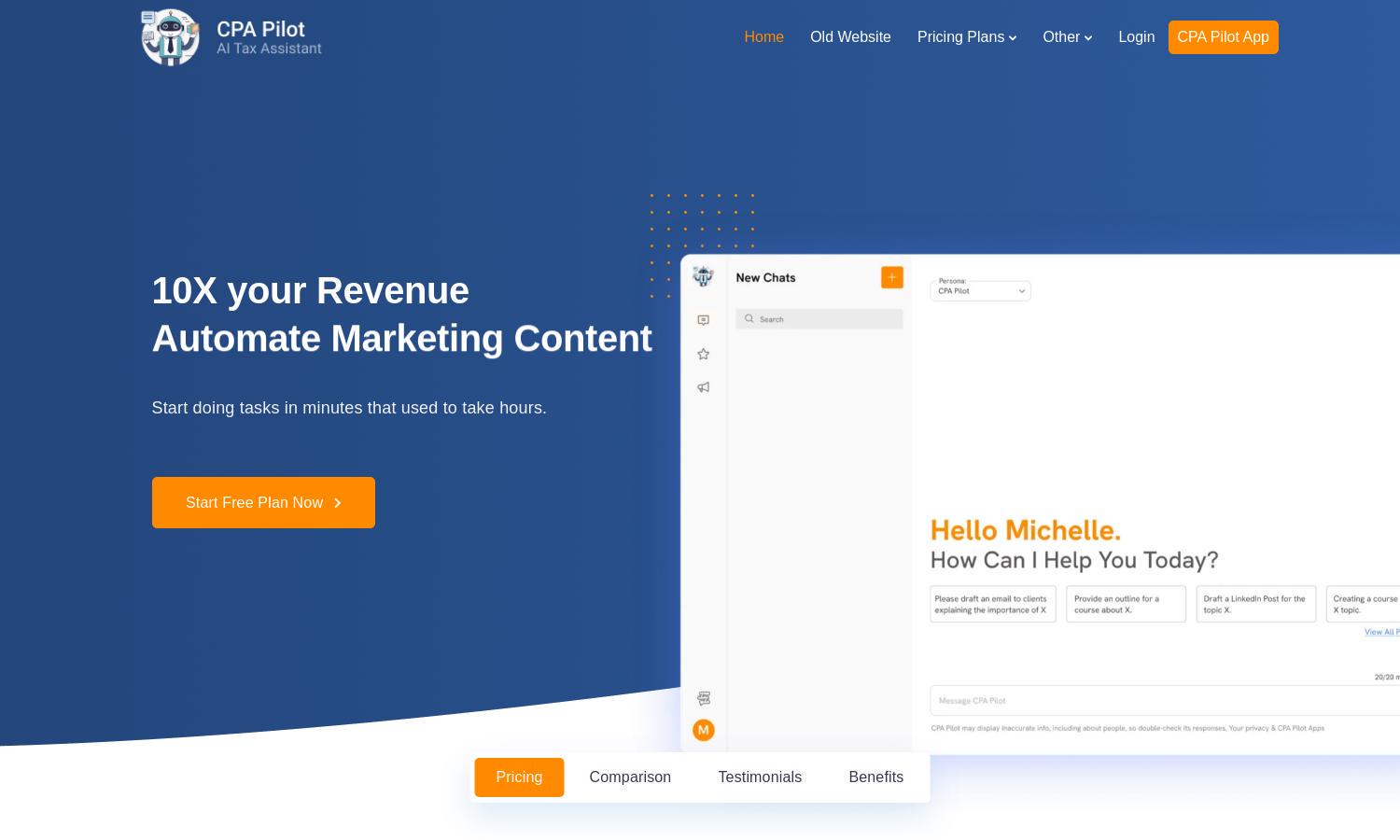

CPA Pilot features a user-friendly interface designed for seamless navigation. The layout facilitates quick access to critical functions, ensuring tax professionals can easily find answers and resources. With intuitive design elements, CPA Pilot enhances user experience, making tax assistance as efficient as possible.

How CPA Pilot works

Users begin by signing up for CPA Pilot and can access a user-friendly dashboard. They enter their tax inquiries or directives, and the AI provides precise answers backed by authoritative sources. By leveraging GPT-4 technology, users can conduct nuanced research, create client communications, and automate marketing seamlessly.

Key Features for CPA Pilot

AI-Powered Research Tool

CPA Pilot’s AI-powered research tool offers tax professionals instant access to authoritative IRS and state resources. This unique feature ensures precise answers for complex inquiries, enhancing user confidence and efficiency in tax research and client interactions while saving valuable time.

Custom Tax Strategy Generation

CPA Pilot excels in generating tailored tax strategies for individual client needs. This feature empowers tax professionals to design bespoke plans quickly, enabling them to meet diverse client requirements effectively and elevating their service quality in a competitive market.

Instant Technical Support

CPA Pilot provides instant technical support, allowing users to quickly resolve software issues without waiting on hold. This unique offering enhances user satisfaction by minimizing downtime, ensuring tax professionals can focus on their clients rather than troubleshooting tech problems.