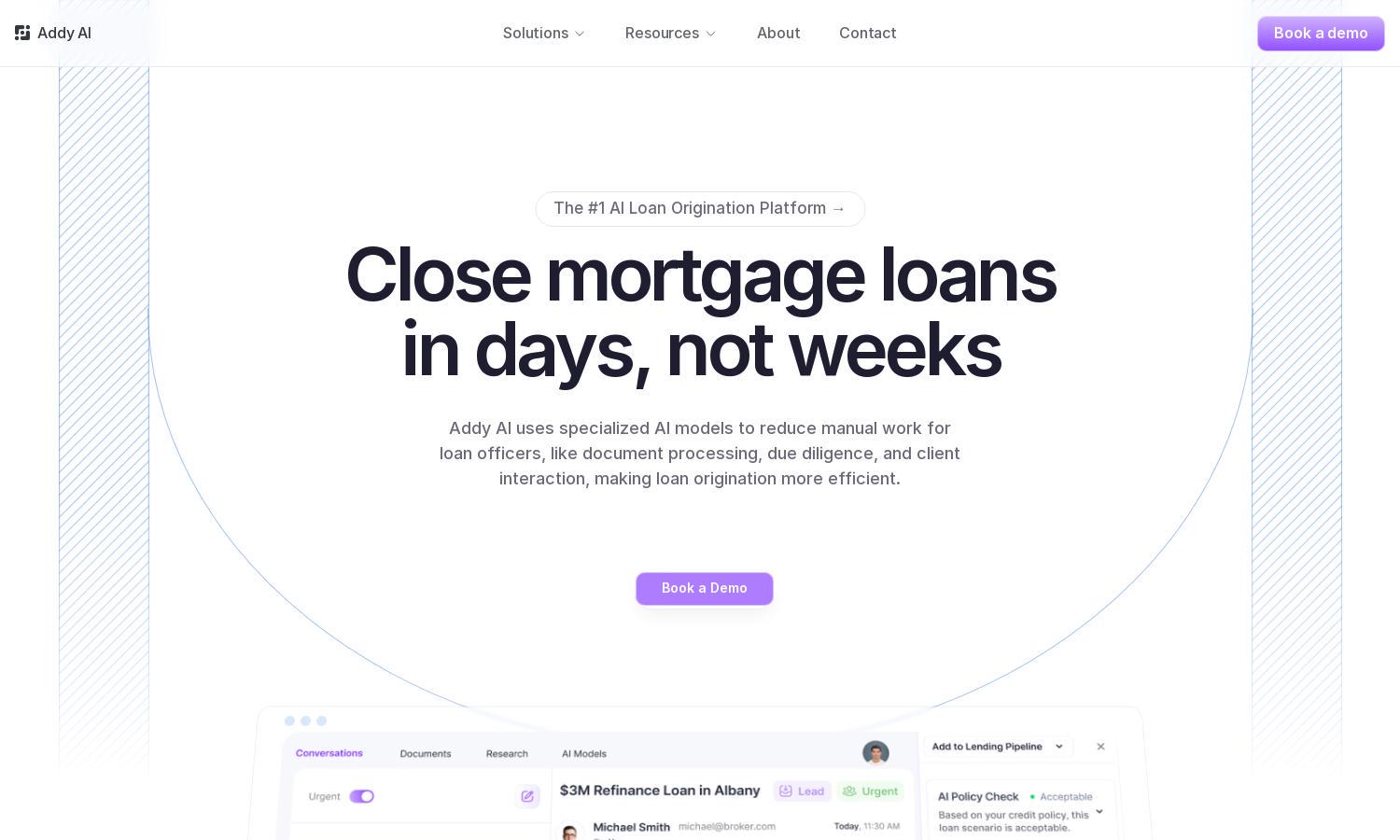

Addy AI

About Addy AI

Addy AI transforms the mortgage lending process by automating loan origination, saving time and resources for lenders. Its innovative feature allows users to train custom AI models that streamline document processing and client interactions, providing a competitive edge in the lending market. Addy AI ensures faster closings and enhanced efficiency.

Addy AI offers flexible pricing plans suited for all lenders. Users can choose from tiered subscriptions, providing features that scale with their needs. Special promotions may apply, enabling cost savings while benefiting from advanced automation functionalities. Upgrade to enhance productivity with Addy AI's capabilities tailored for mortgage professionals.

Addy AI's user-friendly interface creates a seamless browsing experience, allowing users to effortlessly access its features. With intuitive navigation and a clean design, borrowers and lenders can quickly find important documents and tools. Unique features, such as natural language document query, enhance user satisfaction within the Addy AI platform.

How Addy AI works

Users start by signing up with Addy AI, providing their loan origination details and accessing a dashboard of functionalities. They can train custom AI models for automating various tasks like document processing and client follow-ups. The platform integrates seamlessly with existing CRM systems, allowing for real-time loan data updates and easier navigation through mortgage documents.

Key Features for Addy AI

Custom AI Model Training

Addy AI's custom AI model training enables lenders to automate loan processes tailored to their unique workflows. This key feature enhances productivity, reduces manual work, and ensures timely client interactions, positioning Addy AI as a pivotal solution for modern mortgage lenders.

Document Processing Automation

The document processing automation feature of Addy AI allows lenders to extract and analyze relevant data from large documents quickly. By leveraging advanced AI technology, this feature significantly reduces the time loan officers spend on manual data entry, streamlining the overall origination process.

Instant Loan Assessment

Addy AI's instant loan assessment feature rapidly evaluates loans to ensure they comply with credit policies. By providing immediate feedback on borrower eligibility and offering suggestions, this functionality empowers lenders to make informed decisions quickly, enhancing the efficiency of the lending process.

You may also like: